Investment Management Jobs

Welcome To The World Of Investment Management

Want to create sustainable investment solutions and explore new markets? Want to work for a financially strong company and steer portfolios across all asset classes?

Learn more about investment management at Allianz.

Variety of Job Profiles

Drive the Group’s investment strategy, manage a global portfolio, or help providing decision support for regions and entities worldwide with Allianz Investment Management SE (AIM): AIM bundles Allianz Group’s investment function and asset management, offering multiple job opportunities from entry-level positions to jobs for finance experts in different areas along the value chain.

Asset Liability Management

AIM invests the premiums from insurance contracts, according to the insurance liabilities they generate. The Asset Liability Management teams translate the requirements of liabilities into capital market dimensions. This is done via state-of-the-art quantitative models complemented by thorough qualitative analysis. The output of the models is translated into Strategic Asset Allocations for every insurance portfolio, which are the main drivers of our long-term investment results. Our Asset Liability Management experts are a key element of product development when it comes to ensuring a holistic integration of capital market characteristics and developments in insurance products.

Investment Strategy

The Investment Strategy teams – asset class experts and portfolio managers – develop and implement the investment strategy across all asset classes. They develop secular capital market views that serve as input for the Asset Liability Management models and enrich the liability-driven Strategic Asset Allocation by long-term investment strategies. As a member of the Investment Strategy teams, you also analyze capital market developments to derive investment recommendations for portfolio management. The resulting local asset allocations comprise more than 50 investment strategies. Furthermore, the Investment Strategy teams are actively searching for investment opportunities in new asset classes, also referred to as “sourcing”. They position the portfolios to benefit from medium to long-term capital market opportunities while managing market risks.

Asset Manager Management

At Allianz, we differentiate between Investment Management and Asset Management. The Asset Manager Management team takes up the asset allocations and translates those into mandates for Asset Managers. The team oversees selecting, reviewing, and managing the performance of our internal and external Asset Managers on a global basis.

Financial Control

To allow for global portfolio steering, the Financial Control teams independently control the investment risk as well as the investment return. As part of the team, you develop investment plans based on the Strategic Asset Allocation, monitor their implementation, and thus deliver crucial information for decision-making and organizational learning.

Investment Operations

Operations are “backbone” of execution, orchestrating all relevant steps from the settlement of transactions and the management of liquidity to ensuring timely, accurate, and reliable delivery of an investment into our portfolios. Moreover, our Operations teams drive the implementation of processes and related IT systems (e.g., new investments and instruments).

Find Your Next Job in Investment Management

-

Job LevelStudentUnitIDSLocationFrankfurt, DE, 60323Job LevelStudentUnitIDSLocationFrankfurt, DE, 60323Job LevelStudentUnitIDSLocationSelect with space bar to view the full contents of the job information.Frankfurt, DE, 60323

-

Job LevelProfessionalUnitAllianz Global InvestorsLocationFrankfurt, DE, 60323Job LevelProfessionalUnitAllianz Global InvestorsLocationFrankfurt, DE, 60323Job LevelProfessionalUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.Frankfurt, DE, 60323

-

Job LevelProfessionnelsUnitAllianz FranceLocationPUTEAUX, 92, FR, 92800Job LevelProfessionnelsUnitAllianz FranceLocationPUTEAUX, 92, FR, 92800Job LevelProfessionnelsUnitAllianz FranceLocationSelect with space bar to view the full contents of the job information.PUTEAUX, 92, FR, 92800

-

Job LevelStudentUnitAllianz Capital PartnersLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Capital PartnersLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Capital PartnersLocationSelect with space bar to view the full contents of the job information.München, DE, 80333

-

Job LevelProfessionalUnitAllianz Global InvestorsLocationHKJob LevelProfessionalUnitAllianz Global InvestorsLocationHKJob LevelProfessionalUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.HK

-

Job LevelStudent/inUnitIDSLocationMünchen, DE, 80802Job LevelStudent/inUnitIDSLocationMünchen, DE, 80802Job LevelStudent/inUnitIDSLocationSelect with space bar to view the full contents of the job information.München, DE, 80802

-

Job LevelStudent/inUnitIDSLocationFrankfurt, DE, 60323Job LevelStudent/inUnitIDSLocationFrankfurt, DE, 60323Job LevelStudent/inUnitIDSLocationSelect with space bar to view the full contents of the job information.Frankfurt, DE, 60323

-

Job LevelApprentissage / Double cursusUnitAllianz FranceLocationCOURBEVOIE, 92, FR, 92400Job LevelApprentissage / Double cursusUnitAllianz FranceLocationCOURBEVOIE, 92, FR, 92400Job Title ALTERNANCE 2 ans Assistant de souscription responsabilité civile générale et réglementée H/FJob LevelApprentissage / Double cursusUnitAllianz FranceLocationSelect with space bar to view the full contents of the job information.COURBEVOIE, 92, FR, 92400

-

Job LevelBerufserfahrenUnitADEUSLocationMünchen, DE, 80802Job LevelBerufserfahrenUnitADEUSLocationMünchen, DE, 80802Job Title Mitarbeiter:in im Bereich Hauptversammlung und Aktienregister (m/w/d) am Finanzplatz FrankfurtJob LevelBerufserfahrenUnitADEUSLocationSelect with space bar to view the full contents of the job information.München, DE, 80802

-

Job Title Intern - Global Private Debt (f/m/d)Job LevelStudent/inUnitAllianz Global InvestorsLocationMünchen, DE, 80335Job Title Intern - Global Private Debt (f/m/d)Job LevelStudent/inUnitAllianz Global InvestorsLocationMünchen, DE, 80335Job Title Intern - Global Private Debt (f/m/d)Job LevelStudent/inUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.München, DE, 80335

-

Job LevelÉtudiantUnitAllianz FranceLocationCOURBEVOIE, 92, FR, 92400Job LevelÉtudiantUnitAllianz FranceLocationCOURBEVOIE, 92, FR, 92400Job LevelÉtudiantUnitAllianz FranceLocationSelect with space bar to view the full contents of the job information.COURBEVOIE, 92, FR, 92400

-

Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.München, DE, 80333

-

Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.München, DE, 80333

-

Job Title 投资部副负责人Job LevelProfessionalUnitAllianz ChinaLocationShanghai, CNJob Title 投资部副负责人Job LevelProfessionalUnitAllianz ChinaLocationShanghai, CNJob Title 投资部副负责人Job LevelProfessionalUnitAllianz ChinaLocationSelect with space bar to view the full contents of the job information.Shanghai, CN

-

Job Title Deputy Head of InvestmentJob LevelProfessionalUnitAllianz ChinaLocationShanghai, CNJob Title Deputy Head of InvestmentJob LevelProfessionalUnitAllianz ChinaLocationShanghai, CNJob Title Deputy Head of InvestmentJob LevelProfessionalUnitAllianz ChinaLocationSelect with space bar to view the full contents of the job information.Shanghai, CN

-

Job LevelStudentUnitAllianz Global InvestorsLocationPARIS, 75, FR, 75002Job LevelStudentUnitAllianz Global InvestorsLocationPARIS, 75, FR, 75002Job LevelStudentUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.PARIS, 75, FR, 75002

-

Job LevelProfessionalUnitAllianz Global InvestorsLocationFrankfurt, DE, 60323Job LevelProfessionalUnitAllianz Global InvestorsLocationFrankfurt, DE, 60323Job LevelProfessionalUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.Frankfurt, DE, 60323

-

Job LevelProfessionnelsUnitAllianz FranceLocationPUTEAUX, 92, FR, 92800Job LevelProfessionnelsUnitAllianz FranceLocationPUTEAUX, 92, FR, 92800Job LevelProfessionnelsUnitAllianz FranceLocationSelect with space bar to view the full contents of the job information.PUTEAUX, 92, FR, 92800

-

Job LevelStudent/inUnitAllianz Global InvestorsLocationFrankfurt, DE, 60323Job LevelStudent/inUnitAllianz Global InvestorsLocationFrankfurt, DE, 60323Job LevelStudent/inUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.Frankfurt, DE, 60323

-

Job Title 投資部-辦事員~專員Job LevelEntry LevelUnitAllianz TaiwanLocationTWJob Title 投資部-辦事員~專員Job LevelEntry LevelUnitAllianz TaiwanLocationTWJob Title 投資部-辦事員~專員Job LevelEntry LevelUnitAllianz TaiwanLocationSelect with space bar to view the full contents of the job information.TW

-

Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.München, DE, 80333

-

Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationMünchen, DE, 80333Job LevelStudentUnitAllianz Global InvestorsLocationSelect with space bar to view the full contents of the job information.München, DE, 80333

-

Job LevelProfessionalUnitAllianz Investment ManagementLocationMünchen, DE, 80802Job LevelProfessionalUnitAllianz Investment ManagementLocationMünchen, DE, 80802Job LevelProfessionalUnitAllianz Investment ManagementLocationSelect with space bar to view the full contents of the job information.München, DE, 80802

-

Job LevelStudentUnitAllianz Investment ManagementLocationMünchen, DE, 80802Job LevelStudentUnitAllianz Investment ManagementLocationMünchen, DE, 80802Job LevelStudentUnitAllianz Investment ManagementLocationSelect with space bar to view the full contents of the job information.München, DE, 80802

-

Job LevelProfessionalUnitAllianz US LifeLocationMinneapolis, MN, US, 55416Job LevelProfessionalUnitAllianz US LifeLocationMinneapolis, MN, US, 55416Job LevelProfessionalUnitAllianz US LifeLocationSelect with space bar to view the full contents of the job information.Minneapolis, MN, US, 55416

Your Career Opportunities

We offer a wide range of career opportunities in the area of investment management. Explore what suits you best and find your new challenge at Allianz.

- Students: Studies in the area of Mathematics, Business administration/Economics, Finance and Statistics or similar are ideal prerequisites for joining Allianz in the investment section at student level. Combine your studies with practical experience and join us as working student or intern.

- Graduates: Are you motivated to explore the global set-up of Allianz and work closely with experts from various fields? With an academic background in Mathematics, Business administration/Economics, Finance, Statistics or similar you can directly join one of our investment teams or apply for our Graduate Program. Find more information about Investment Management careers and opportunities in our global job search.

- Professionals: We are looking for professionals who have stayed up-to-date with the latest developments in the business sector. Use your expert understanding in investments, your knowledge of the capital markets or your digital competences to contribute to our business.

-

Sustainable Investments

At AIM, we are convinced that a strong approach towards environmental, social and governance (ESG) management is key to mitigating risks and seizing opportunities. Our ESG strategy combines long-term economic value creation with a concept of environmental voluntary commitment, social responsibility, and strong corporate governance. We use ESG scoring for listed assets and evaluate non-listed assets case by case, based on ESG criteria. Investments in controversial weapons or coal-based business models are excluded. Instead, our portfolios encompass investments in renewable energy, green bonds, certified green buildings, and debt financing of certified green buildings amongst others.

An image showing miniature windmills

-

Bridging Insurance and Capital Market

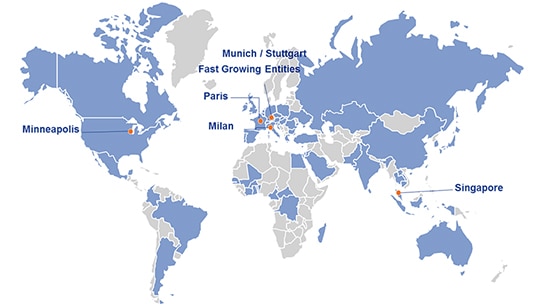

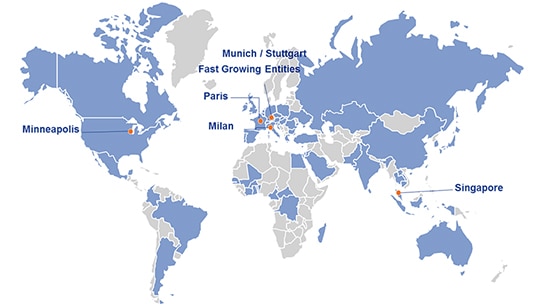

At AIM, you will work in a thrilling environment linking capital markets, investment management and insurance business. AIM operates in five office hubs worldwide and in the local insurance companies: The teams in the hubs are monitoring the actual portfolios of the Allianz insurance companies in the respective regions and preparing analysis for local management and Allianz Group. The teams in the Global Functions provide and aggregate expertise across the hubs. They prepare investment analyses on a global scale, develop recommendations for the portfolios, monitor strategic developments in the markets and propose investment solutions, tailor-made to the needs of the hubs.

An image showing investment management world map

-

Meet Sebastian from Team Allianz

"I help to manage the approx. EUR 90bn alternative debt portfolio. This is extremely exciting because of the variety of topics that range from infrastructure financing in Africa to real estate lending in the U.S."

Sebastian, Allianz

An image showing a man

Discover How Fast Applying Can Be

Just follow these six simple steps to apply at Allianz:

Career Development

We care about your opportunities for advancement. Individual development, career mobility, and lifelong learning opportunities are available to all of our employees worldwide.